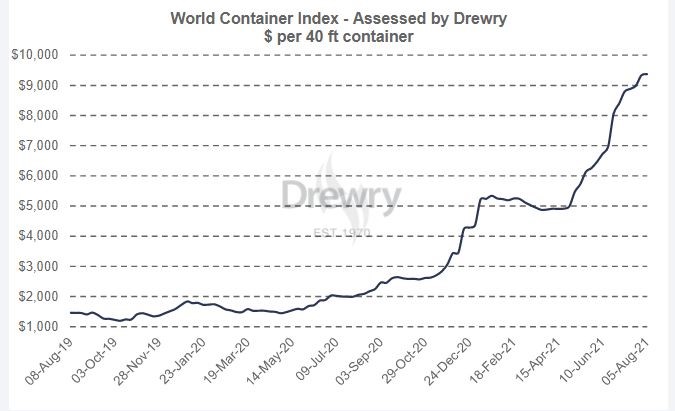

As costs of raw materials and freight rise, some suppliers are facing the dilemma of locked-in product prices with customers and an inability to respond to declining profit margins. Historically, suppliers have been able to manage or internally absorb what were typically minimal fluctuations in costs. However, continued disruptions to the global supply chain due to shipping container shortages, a pandemic, a boat stuck in a canal, forest fires, extreme cold spells, and a host of other reasons have caused costs for certain raw materials and for freight to spike rapidly and to extremes that suppliers are unable to withstand. For example, ocean shipment costs skyrocketed in August 2021 to a rate approximately 6 times the rate that it was just two years earlier, as is demonstrated by the Drewry World Container Index below.

Source: World Container Index, Drewry Shipping Consultants Limited, https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry.

Given the rapidly changing supply chain landscape, how can a supplier address its rising costs in its pricing to its customers?

Existing Contracts

For existing contracts with customers, the options available to address rising costs are limited. A review of the terms of existing contracts is necessary before a supplier can determine how to best handle increased costs. First, if the parties are operating under a master or blanket agreement without any specific volume requirement, it is possible that the supplier is not obligated to continue to supply goods at the price in the agreement. Second, it may be that the agreement already incorporates a pricing mechanism, such as index-based pricing described below, to address the issue within the terms of the contract.

If there is no such pricing mechanism, a supplier may determine that the best approach is to negotiate with the applicable customers in order to find a commercial resolution. A supplier can ask a customer to share in certain expenses (like freight costs), citing the financial pressure of continuing to supply the products to customers at a negative balance. In this way, a supplier can attempt to preserve an amicable relationship with its customers while still responding to the hardships imposed by an unexpected spike in costs.

Many suppliers are considering a claim of excused performance of a contract via a force majeure provision. Unfortunately, force majeure is typically not an appropriate method for suppliers to incorporate their rising costs into the price charged to buyers for a product. Courts typically construe force majeure provisions with a narrow focus on contractual language. Further, courts tend to be averse to excused performance of contracts for increased costs alone, at least without another intervening cause.

Instead of trying to handle increased costs through force majeure provisions, suppliers may prefer to address the potential for increased costs at the outset through pricing terms.

Future Contracts

When initially negotiating a contract, a supplier can seek to include language addressing potential future cost increases with a number of approaches, including the approaches listed below.

Order by Order Basis. A supplier may seek to avoid fixing long term pricing by quoting prices on an order by order basis. This will permit the supplier to have greater flexibility to change the pricing as circumstances evolve without changing the terms of any overarching master agreement.

Right to Cancel. A supplier may negotiate a set price at the outset of the agreement, but also include a clause that states that a new price may be proposed by the supplier. In these circumstances, the supplier retains the right to cancel the agreement in the event that the customer does not accept the newly proposed price. This allows the supplier to avoid being locked-in to a set pricing arrangement without a right of cancellation and permits the supplier to propose new terms if necessary.

Pass Through of Rising Costs. Alternatively, parties may decide to include a mechanism that permits the supplier to directly pass through increases of specific inputs or freight costs to the customer. The clause must clearly state how the new price is calculated, and only increases that are directly tied to the cost that is charged to the supplier may then be passed along to the customer. In this situation, the pricing should be clearly tied to a direct increase in external costs, without arbitrary adjustments from the supplier. A customer may require that the supplier provide documented evidence of such cost increases to invoke this provision.

Indexed Pricing. Another mechanism that parties might use to keep pricing aligned with costs is tie the price of a product to an industry specific index, such as steel indices or shipping indices. This allows the supplier to distance itself from the increase to the customer by providing a clear external figure over which neither party can exercise any control. It also avoids the supplier having to open its books to the customer to justify the price increases.

Uncertainty is the only thing certain about the global supply chain in the foreseeable future, and suppliers will need to continue to look for ways to mitigate the effect on their bottom line.