David W. Kantaros

Partenaire

David Kantaros est coprésident du secteur Intelligence artificielle au sein de notre division Technologies innovantes et membre des divisions Capital-investissement et capital-risque et Transactions et valeurs mobilières. Il représente des fonds de capital-risque et de capital-investissement ainsi que des sociétés cotées et non cotées dans les secteurs des technologies émergentes et des sciences de la vie.

L'expérience de David comprend : la représentation de fonds de capital-investissement, de family offices et de sociétés publiques et privées dans le cadre de fusions et acquisitions, de coentreprises, d'offres publiques et d'investissements de contrôle ; le conseil aux sociétés de capital-risque, aux investisseurs stratégiques, aux particuliers fortunés et aux groupes d'investissement dans le cadre d'activités de placement privé, y compris le financement par actions privilégiées et par emprunts garantis et convertibles dans des sociétés technologiques et des sociétés du secteur des sciences de la vie ; le conseil aux sociétés de haute technologie, ainsi qu'aux sociétés de biotechnologie, pharmaceutiques et de dispositifs médicaux en matière de structure d'entreprise, de protection technologique et de transactions ; conseiller les investisseurs, les conseils d'administration et les sociétés publiques et privées sur des transactions nationales et transfrontalières complexes, notamment les migrations d'entreprises, les re-constitutions et les accords de coentreprise ; et structurer et négocier des accords de licence technologique, notamment des accords de licence-cadre, des accords OEM, des accords de test bêta, des accords de vente sous emballage et des relations stratégiques impliquant le partage de technologies.

Expérience des représentants

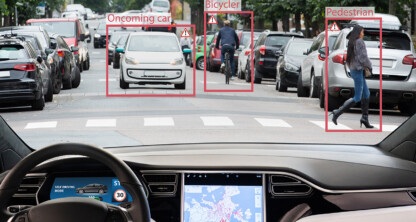

- Représentation de Torc Robotics, société spécialisée dans les technologies de véhicules autonomes et filiale indépendante de Daimler Truck AG, dans le cadre de son acquisition d'Algolux Inc. (2023).

- Représentation de Patient Funding Alternatives dans le cadre de sa vente à des filiales de Leonard Green & Partners (2022).

- Représentation de SymphonyAI, leader dans le domaine des solutions SaaS d'IA à forte valeur ajoutée pour les industries stratégiques, dans le cadre de son acquisition de NetReveal, leader dans la détection des crimes financiers, auprès de BAE Systems (2022).

- Représentation de Digital Guardian, fournisseur SaaS de solutions de prévention des pertes de données (DLP), dans le cadre de sa vente à HelpSystems (2021).

- Représentation de Panalgo, une société d'analyse de données dans le domaine de la santé, dans le cadre de sa vente à Managed Markets Insights & Technology (2021).

- Représentation de 829 Studios, une société de services de marketing numérique, dans le cadre d'un investissement de contrôle par CVIC Partners (2021).

- Représentation de la Mayo Clinic dans le cadre d'un investissement stratégique avec Kaiser Permanente dans Medically Home, une société de services technologiques fournissant des plateformes pour les soins à domicile (2021).

- A agi en tant que co-conseiller juridique pour AST Space Mobile, un développeur de réseau cellulaire à large bande spatial accessible par smartphone, dans le cadre de son introduction en bourse via une SPAC, avec une valeur nette de 1,8 milliard de dollars américains (2021).

- Représentation de Symphony AI dans le cadre de son acquisition de TeraRecon, une société spécialisée dans l'imagerie médicale basée sur l'IA (2020).

- Représentation de Marathon Venture Capital dans le cadre d'un investissement de série A dans Velos Rotors, Inc., une société spécialisée dans les hélicoptères sans pilote (UAV) (2023).

- Représentation d'Alpine Space Ventures en tant qu'investisseur principal dans le cadre d'un financement de série A auprès de Morpheus Space, Inc., l'un des principaux fournisseurs de mobilité par satellite (juillet 2022).

- Représentation de Braemar Energy Ventures dans le cadre de son financement par actions privilégiées dans Renew Financial Holdings, une société qui fournit des solutions de financement innovantes aux entrepreneurs en bâtiment (2022).

- Représentation de ConcertAI, une start-up spécialisée dans les données réelles et les logiciels SaaS dans le domaine de l'oncologie, dans le cadre d'un financement de série C de 150 millions de dollars américains auprès de Sixth Street Partners, avec une valorisation de 1,9 milliard de dollars américains (2022).

- Représentation de Teikametrics, la principale plateforme d'optimisation pour les vendeurs sur Amazon et Walmart, dans le cadre d'un financement de série B de 40 millions de dollars américains mené par Intel (2021).

- Représentation d'Utilidata, une société leader dans le domaine des logiciels de pointe, dans le cadre d'un financement de série D de 26 millions de dollars américains auprès de Moore Strategic Ventures (MSV), Microsoft Climate Innovation Fund et NVIDIA (2022).

- Représentation d'AIMI, une plateforme musicale alimentée par l'IA, dans le cadre d'un financement de série B de 20 millions de dollars américains auprès de Great Mountain Partners et Founders Fund (novembre 2021).

- Représentation de Stage 1 Ventures dans le cadre d'un investissement de 52 millions de dollars américains dans des actions privilégiées de Witricity, une société spécialisée dans la recharge sans fil, avec des co-investissements d'Air Waves Wireless Electricity et de Mitsubishi Corporation (Americas) (2021).

- Représentation d'AST&Science dans le cadre d'un financement de série B de 128 millions de dollars américains auprès de Rakuten, Vodafone, American Tower et Samsung Next (2020).

Prix et reconnaissance

- Sélectionné pour figurer dans les éditions Massachusetts Super Lawyers–Rising Stars®pour son travail dans le domaine des valeurs mobilières et du financement des entreprises (2005, 2006)

- Sélectionné par ses pairs pour figurer dans le classement The Best Lawyers in America©dans le domaine du droit du capital-risque (depuis 2012)

Leadership éclairé

David a donné des conférences sur des questions liées à la représentation de fonds de capital-risque et de sociétés de portefeuille dans le cadre de financements par capitaux privés, à la représentation d'acheteurs et de vendeurs dans le cadre de fusions et acquisitions, ainsi qu'à la structuration de relations stratégiques et de coentreprises autour de développements technologiques.

Affiliations

- Membre de l'American Bar Association

- Membre, Association du barreau du Massachusetts

Les défis du financement de l'IA dans le domaine de la santé : un guide pour les fondateurs et les investisseurs

Les avocats de Foley mis à l'honneur dans le cadre du groupe d'experts sur l'IA dans le domaine des soins de santé

Deuxième conférence annuelle des gestionnaires de fonds privés

L'IA et la Grèce : une destination émergente pour l'innovation

Réseau hellénique d'innovation de New York : Innovation et impact