The Consolidated Appropriations Act’s Compensation Disclosure Provisions from a Carrier and Plan Service Provider Perspective

Overview

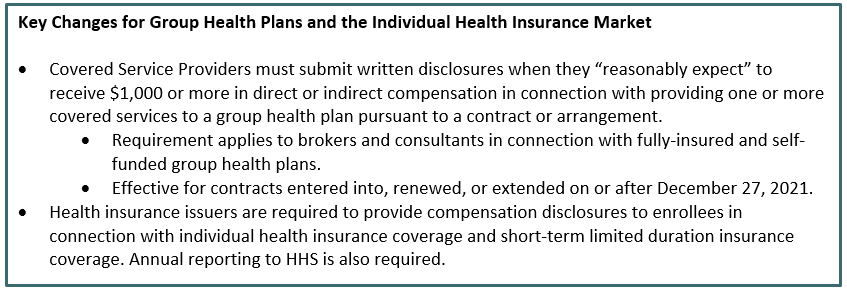

The Consolidated Appropriations Act, 2021, Public Law 116-260 (CAA) sets forth new compensation disclosure requirements that apply to brokers and consultants with respect to both fully-insured and self-insured group health plans subject to the Employee Retirement Income Security Act of 1974 (ERISA). Separately, the CAA incorporates similar compensation disclosure requirements for individual market coverage via the Public Health Service Act. Importantly, disclosure requirements in the group health context apply to “Covered Service Providers” (e.g., brokers and consultants) whereas they apply to health insurance issuers in the individual market context.

New Federal Regulation of Agents and Brokers

While the new compensation disclosure requirements applicable in the group health plan context largely incorporate concepts that have long been applicable to ERISA-covered retirement plans, the more direct federal regulation of agents and brokers under the CAA marks a potentially significant change from traditional state-based regulation. What is more, the new individual market disclosure requirements (which lack even the cover of the ERISA justification) consist of a federal mandate not only to report agent and broker compensation to enrollees but to report agent and broker compensation to the federal government. Regulations are still being finalized, but it appears that this will be a separate annual report on agent and broker compensation. Although HHS would undoubtedly take the position that this is merely “a data call,” it is nonetheless a relatively significant departure from what has been exclusively state-based regulation of agents and brokers in the context of commercial health coverage. It remains to be seen whether state insurance regulators and the National Association of Insurance Commissioners will follow suit in terms of new, or nuanced, state-based disclosure requirements.

Background: Group Health Plan Requirements

The new compensation disclosure requirements for group health plans have been proposed and incorporated into ERISA and codified at 29 U.S.C. § 1108, which describes the permissible exemptions to ERISA’s “prohibited transactions.” A transaction will not be prohibited if when “contracting or making reasonable arrangements with a party in interest . . . no more than reasonable compensation is paid.” The new compensation disclosure requirements are aimed at allowing the ERISA “responsible plan fiduciary” to determine that “no more than reasonable compensation” has been paid. Failure to comply with these new requirements will mean, by default, that the exemption will not apply and that the transaction will be a prohibited transaction (subject to certain opportunities to cure).

Details: Group Health Plan Requirement

The term covered service provider is defined as a service provider that enters into a contract or arrangement with an ERISA-covered group health plan (referred to herein as a “covered plan”) and reasonably expects $1,000 in direct or indirect compensation to be received in connection with providing one or more of the services listed below (see chart) pursuant to the contract or arrangement (Covered Service Provider). The definition of “group health plan” under these requirements seems to capture more than just major medical plans, and includes dental, vision, health reimbursement arrangements (HRAs), health flexible spending accounts (health FSAs), most employee assistance programs (EAPs), certain wellness programs, and most other plans providing health benefits (these requirements do not explicitly carve out “excepted benefits” as some other health care reform rules do). A covered plan would obviously not include non-health coverage such as life insurance.

Direct compensation means compensation received directly from a covered plan. Indirect compensation means compensation received from any source other than a covered plan, the plan sponsor, the covered service provider, or an affiliate. Compensation received from a subcontractor is indirect compensation, unless it is received in connection with services performed under a contract or arrangement with a subcontractor. Compensation received by the Covered Service Provider’s affiliate or subcontractor is counted for purposes of the $1,000 minimum threshold. These requirements apply regardless of whether the services are performed or compensation is received by the Covered Service Provider, an affiliate, or a subcontractor.

Details: Group Health Plan Brokerage Services and Consulting

The chart below sets forth the types of consulting and brokerage services subject to the CAA disclosure requirements. We have provided the statutory list in chart form for ease of comparison. We note that there is an acknowledged lack of clarity in terms of the scope of services and what plan service providers are subject to these requirements, particularly with respect to the consulting category. Forthcoming regulations should hopefully provide additional guidance. For example, it is not clear based on the statutory language alone whether “consulting” with respect to a third party administrator (TPA) is limited to making recommendations about choice of TPA or whether a TPA that advises on network selection and benefit design would itself be considered a Covered Service Provider under the “Consulting” category. Given the broad scope of the “Consulting” category, it seems that this could arguably capture several types of plan service providers, such as TPAs, pharmacy benefit managers (PBMs), HRA administrators, EAP administrators, wellness vendors, health FSA administrators, and other types of health benefit administrators. However, we have no confirmation either way from the regulators on this point.

|

Brokerage Services provided to a covered plan with respect to . . . |

Consulting related to . . . |

|

|

Details: Group Health Plan Disclosure Notice and Timing

The Covered Service Provider must disclose the following, in writing, to the responsible plan fiduciary not later than the date that is reasonably in advance of the date on which the contract or arrangement is entered into (or extended or renewed):

- A description of the services to be provided;

- A statement (if applicable) that the Covered Service Provider, affiliate, or subcontractor will provide services as a fiduciary;

- A description of all direct and indirect compensation that the Covered Service Provider, affiliate, or subcontractor reasonably expects to receive in connection with the services;

- including compensation from a vendor to a brokerage firm based on a structure of incentives not solely related to the contract with the covered plan; and

- not including compensation received by an employee from an employer on account of work performed by the employee.

- A description of the arrangement between the payer and the Covered Service Provider, an affiliate, or a subcontractor, as applicable, pursuant to which such indirect compensation is paid.

- Identification of the services for which the indirect compensation will be received, if applicable.

- Identification of the payer of the indirect compensation.

- A description of any compensation that will be paid among the Covered Service Provider, an affiliate, or a subcontractor if paid on a transaction basis (such as commissions, finder’s fees, or other similar incentive compensation based on business placed or retained), including identification of the services for which such compensation will be paid and identification of the payers and recipients of such compensation (including the status of a payer or recipient as an affiliate or a subcontractor), regardless of whether such compensation also is disclosed under another provision.

- A description of any compensation that the Covered Service Provider, an affiliate, or a subcontractor reasonably expects to receive in connection with termination of the contract or arrangement, and how any prepaid amounts will be calculated and refunded upon such termination.

Changes in information must be disclosed as soon as practicable but not later than 60 days from the date of discovery.

Background: Individual Market

Health insurance issuers are required to provide compensation disclosures to enrollees in connection with individual health insurance coverage and short-term limited duration insurance coverage. Annual reporting to HHS is also required.

Details: Individual Health Insurance Market Requirement

Under the new provisions of the CAA applicable to the individual market, a health insurance issuer offering individual health insurance coverage or a health insurance issuer offering short-term limited duration insurance coverage is required to provide compensation disclosures to enrollees and to HHS.

With respect to enrollees, the health insurance issuer (the carrier) must disclose the “amount of direct or indirect compensation provided to an agent or broker for services provided by such agent or broker associated with plan selection and enrollment.” In terms of timing, the disclosure has to be made before plan selection is final, and it must be documented on the individual’s final enrollment.

Reporting to HHS, on the other hand, is required annually. That report must be made by the health insurance issuer before the beginning of open enrollment and it must include “any direct or indirect compensation provided to an agent or broker associated with enrolling individuals in such coverage.”

The CAA requires rulemaking on these particular provisions within a year of enactment. A Proposed Rule was published in September and the Comment Period closed October 18, 2021. We will continue to monitor the space for final regulations.

Effective Dates

The compensation disclosure requirements for both the group and individual markets are effective for contracts entered into, renewed, or extended on or after December 27, 2021.

Foley is here to help you address the short- and long-term impacts in the wake of regulatory changes. We have the resources to help you navigate these and other important legal considerations related to business operations and industry-specific issues. Please reach out to the authors, your Foley relationship partner, or to our Health Care Practice Group with any questions.