Mexico: There Is a (Growing) Liability in Your Fixed Assets –Which You Know You Have

Fixed assets represent a significant capital investment for manufacturing companies, though, once made, they are just there to produce as expected and that is it, right? Not quite. We have recently seen a surge in Mexican Local (State) authorities auditing fixed assets importation-compliance as per their collaboration abilities (sic) with the Mexican Federal Treasury.

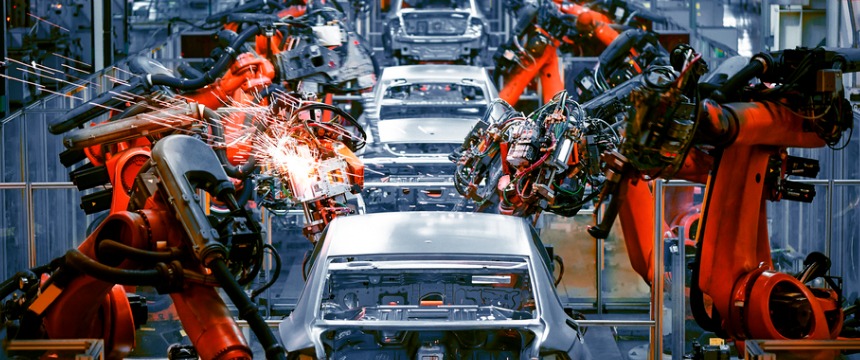

Global manufacturing companies with Mexico presence ordinarily have a significant number of foreign-made fixed assets (usually machinery and equipment) at their production sites that were either acquired from third parties in Mexico (local vendors), or imported from abroad.

Mexican Customs Law holds that, as one would expect, importers are obliged to observe its provisions; nevertheless, those that also handle, transport or possess imported products -upon request and without statute of limitations- are required to prove the legal importation of such products.

We should note that the aforementioned obligations cover all type of imported products, but for personal-use products, yet, ordinarily, authorities routinely go for fixed assets.

Thus, legal handling, transportation and possession of foreign goods shall be proven with any of the following documents: (i) fully-compliant importation documents as per Mexican Customs Law, (ii) a registered Mexican taxpayer´s Electronic invoice that perfectly complies its legal requirements (known by its Spanish acronym “CFDI”), or (iii) a sales note issued by the Ministry of Finance –an exception.

At any given moment, Federal or Local authorities may knock on your door and request your company to demonstrate the legal importation and possession of foreign-made goods. If after a non-extendable 10 business day period, your company cannot prove so as per their standards, authorities will eventually be entitled to issue an assessment requiring the payment of omitted importation duties, Value Added Tax, Customs processing fees and antidumping fees if applicable, followed by relevant penalties.

As if that were not enough, not proving the legal acquisition or importation of foreign goods may cause the relevant goods to become property of the Mexican Federal Treasury.

The aforementioned nightmare can be avoided if you keep your ducks in a row, this is, if your files demonstrate the legal acquisition or importation into Mexico of foreign machinery and equipment. In a nutshell (important details apply), when importing foreign goods into Mexico, importers are obliged to electronically transmit the pedimento importation document along with, among others, documents proving the value of the good, a valid certificate of origin, transportation bill, and compliance certificates of Mexican Mandatory Standards (aka NOMs as per their acronym in Spanish).

Also, importers (and by extension those that handle, transport or possess imported products) shall declare the particular identification information of the goods; for instance, machinery and equipment should be identified by trademark, model, serial number and commercial description.

Importers / handlers / transportation companies / possessors must therefore keep all of the aforementioned relevant documents complete and in the same form in which they were submitted (in recent times, in electronic format).

In case you lack the relevant means to prove the legal importation of foreign-made goods, there is a legal procedure to self-correct through definitive importation; this is, by paying omitted duties, taxes, fees, and applicable fines. Whether this is of any benefit, it depends on the particulars of your situation.

Therefore, it is recommended that all global companies doing business in Mexico, perform selective audits on randomly selected fixed assets (are your coffee or vending machines relevant?) and evaluate sufficiency as per Mexican Customs Law, or risk it (you are 100% sure it will not happen to you, right?), and provide everything as per Mexican Customs´ practice in 10 business days.