Using M&A and Other Strategic Transactions to Enhance EV-Launch Readiness

Auto Trends Series: Article 3

In 2022 automotive original equipment manufacturers, suppliers, startups, and other participants in the electric vehicle (EV) ecosystem used mergers and acquisitions, joint ventures, and strategic transactions to enhance their capabilities. This was driven in part by the desire to capture a larger share of the rapidly growing EV market, take advantage of significant state and federal financial incentives, and redomesticate portions of the EV supply chain for tax credits provided under the Inflation Reduction Act of 2022 and other government programs.

Automotive M&A Snapshot

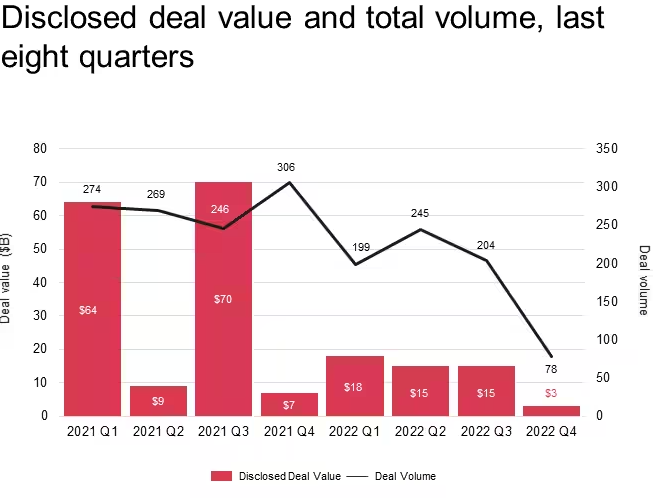

According to data from PwC1, overall global automotive M&A deal volumes from January to mid-November 2022 were down by 18% (approximately 900 deals) compared to 2021, and deal value fell by 62% (US$57 billion) year-over-year. That being said, PwC expects automotive deal volumes to “remain stable” in 2023 amid a disciplined environment for capital deployment resulting from inflation and higher interest rates. Disclosed automotive deal value and volume for the last eight quarters are presented below:

Source: PwC and Refinitiv

In part, this trend reflects the overall performance of the M&A market in 2022 as deal value and volumes fell dramatically from near-historical 2021 levels. Macroeconomic factors such as continuing supply chain challenges, inflationary pressures and their impacts on interest rates, and recession fears also impacted transaction volume within the industry.

Here are some representative examples of automotive transactions announced in 2022:

- February: Certain funds managed by affiliates of Apollo Global Management entered into an agreement to acquire Tenneco from The Vanguard Group, Fuller & Thaler Asset Management, BlackRock, and others for approximately US$1.8 billion.

- March: General Motors announced its intention to acquire SoftBank Vision Fund 1’s equity ownership stake in Cruise Automation for US$2.1 billion.

- April: Compagnie Plastic Omnium SE entered into an agreement to acquire Varroc Lighting Systems from VarrocCorp Holding B.V. for €600 million.

- September: Aptiv announced that it will acquire Intercable Automotive Solutions, an Italian supplier of automotive power distribution and connection technologies, for €595 million.

- September: Porsche completes its IPO at a US$72 billion valuation.

- December: BorgWarner announced plans to spin off its fuel systems and aftermarket segments into a separate, publicly traded company. Following the completion of the spin-off, BorgWarner would consist of the company’s electric propulsion & drivetrain and air management segments.

Electric Vehicle M&A Activity

2022 also saw a number of announced transactions involving EVs, especially in the charging space. Key factors driving this activity include federal infrastructure funding, state incentives encouraging such investment, and an overall market opportunity driven by a need for U.S. charging infrastructure to grow significantly in order to support the anticipated market adoption of EVs and ambitious OEM production plans for EVs.

According to an October analysis released by PwC2, the EV charging market could – and will need to – grow nearly tenfold to satisfy the charging needs of an estimated 27 million EVs on the road by 2030. The report also noted that more than twenty EV charging startups in the EU and US have been acquired since 2021, several by major energy companies. As an example, Blink Charging has acquired four startups since 2020, including Maryland-based SemaConnect for approximately US$200 million in June 2022. Further, at least five EV charging companies have gone public via special purpose acquisition companies (SPACs) since 2020, including most notably ChargePoint in February 2021.

Bloomberg3 also reported that more than US$4.8 billion was invested globally in the electric-vehicle charging industry between January – August 2022, a number that includes acquisitions, investments, debt financing, and roll-out announcements. Their analysts predict cumulative investment in charging will exceed US$360 billion globally by 2030 and more than US$1 trillion by 2040 to meet market needs.

So which players have been active in the EV M&A space? OEMs, suppliers, charging equipment companies, energy and utility companies, large conglomerates, and new market entrants/startups have all been involved in acquisitions, investments, and partnerships to expand charging infrastructure in the U.S. Representative transactions in the EV market in 2022 included the following:

- January: ABB acquired a controlling stake in California-based charging station developer InCharge Energy.

- January: Daimler Truck North America, BlackRock Renewable Power, and NextEra Energy Resources announced their plan for a US$650 million joint venture to build charging infrastructure for electric and hydrogen fuel cell medium- and heavy-duty trucks in North America. The first phase of construction should begin in 2023 on a network of charging sites on critical freight routes along the East and West coasts, with a second phase in Texas by 2026. The companies intend to leverage existing infrastructure and amenities while adding greenfield sites.

- June: Canadian electric vehicle charging company FLO announced that it would invest US$3 million to open its first U.S. manufacturing facility in Auburn Hills, Michigan.

- June: Schneider Electric acquired California-based EV charging solution provider EV Connect, Inc.

- June: Siemens announced that it would invest a low triple-digit million USD amount in Volkswagen Group’s Electrify America unit.

- August: Wallbox announced it will acquire San Francisco-based EV charging installation services company COIL.

- August: BorgWarner acquired San Diego-based Rhombus Energy Solutions for US$130 million in a deal expected to expand BorgWarner’s vehicle-charging capabilities.

- September: Hertz announced plans to develop a national network of EV charging stations with BP.

- September: San Francisco-based TeraWatt Infrastructure, which builds EV charging infrastructure for fleets, raised US$1 billion of Series A venture funding. The company plans to use the funding to expand its portfolio of commercial charging centers, beginning in the western U.S.

- October: Orion Energy Systems acquired Massachusetts based Voltrek for an undisclosed amount. Voltrek provides turnkey EV charging solutions and ongoing support to commercial vehicles.

- November: Volvo and Pilot announced plans to build a network of charging stations for battery-electric Class 8 trucks at Pilot and Flying J locations across the U.S. Earlier last year, General Motors also announced it would partner with EVgo and Pilot to install 2,000 fast chargers at up to 500 Pilot and Flying J locations, and the first chargers will be operational early 2024.

Given the drivers noted above, 2023 M&A activity in the EV space is expected to outpace general automotive M&A activity as global players of all stripes continue to position themselves for the growing market opportunities. Automotive suppliers with strong balance sheets are expected to use M&A and joint venture activity in 2023 as a way of accelerating their EV launch capabilities, in part as a way to shortcut or share the significant capital expenditures required.

At the same time, this “Great EV Gold Rush” will not pan out for all participants given the significant execution risks, market adoption timing uncertainties, capital financing challenges, and the expected failures that accompany any rapid technology adoption. This may naturally lead to additional M&A opportunities to acquire distressed EV companies through Section 363 bankruptcy sales or other distressed/rescue transactions. Players with strong strategies and access to capital can take advantage of the EV market opportunities and enhance their launch capabilities and profiles in the eyes of their customers.

Subscribe to the Auto Trends 2023 Series

For an ongoing discussion of where the industry is going, we invite you to subscribe to this Auto Trends 2023 Series by clicking here.

1 Elie, Paul and Ritchie, Michelle. “Automotive: US Deals 2023 outlook.” PwC, December 2022.

2 Singh, Akshay and Manthena, Anand. “The US electric vehicle charging market could grow nearly tenfold by 2030: How will we get there?” PwC, September 2022.

3 Fisher, Ryan. “Car-charging investment soars, driven by EV growth and government funds” Bloomberg, 16 August 2022.