Family Offices

The goal of any family office is the preservation of the family’s legacy. At Foley, we can assist you in building a family office to protect, manage, and grow your wealth across generations. Whether the founder is still engaged, or your family is transitioning to the next generation, you will receive legal services tailored to ensure the success and longevity of your family enterprise.

Whether the business founders are still engaged with the family business, the family is preparing for the next steps after a liquidity event, or the family is transitioning leadership to the next generation, Foley attorneys have the experience and creativity to provide tailored, innovative, and practical solutions for you, your family, and your business.

Our team has significant experience with structuring new family offices under the Lender decision, investment pools, and complex estate and tax planning. We can address a broad array of legal needs, including private investments, investment due diligence, philanthropy, aircraft, employment issues, and family office staff compensation, among others.

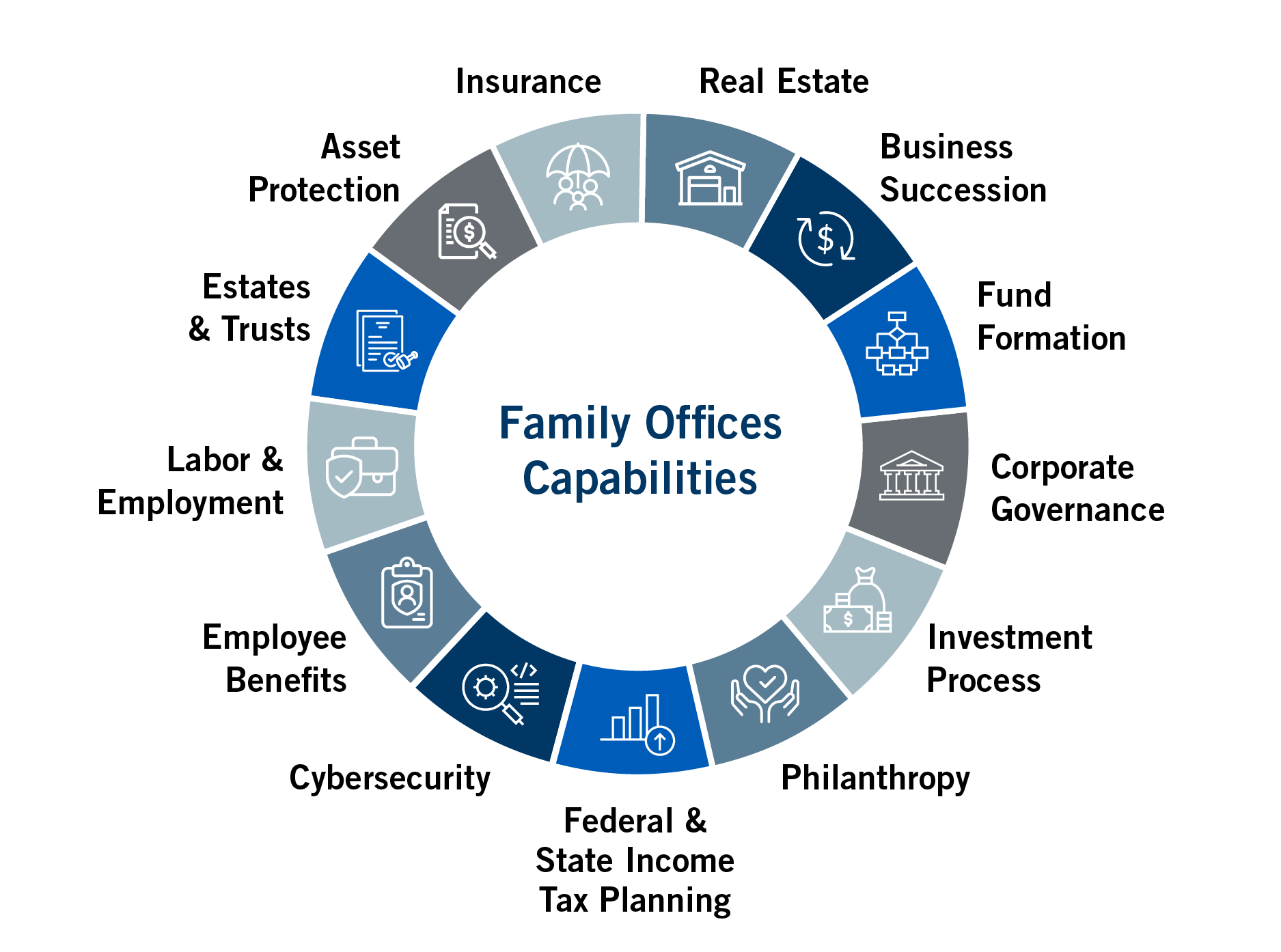

We work with family members and individuals in all different stages of wealth management — from business leaders with multiple years of experience to those who are just beginning to learn about the intricacies of family wealth. In addition to legal experience, we bring Foley’s long legacy of working with family businesses as well as an appreciation for the non-legal challenges and sensitivities that can arise when working with families. We also pride ourselves on working collaboratively alongside our client’s other advisors. Whatever your needs — we can provide support and strategies to move the ball forward. We work with our clients on a variety of areas and topics including:

Representative Matters

- Representing family offices making direct private investments and transactions, including rollover incentive compensation arrangements.

- Designing and implementing Lender style carried interest funds to decrease the after-tax cost of a family office.

- Counseling family offices on making private equity and side-car investments.

- Representing family members serving as corporate directors of family office owned businesses and designing methods for consolidated decision-making for legacy assets.

- Designing and implementing installment sales to facilitate cross-generational transfer of privately held business interests with no or limited estate tax.

- Implementing state income tax strategies for personal and trust residence to mitigate state income tax.

Contacts

Brian L. Lucareli

Director of Foley Private Client Services

[email protected]