Pricing Stability and Supply Continuity: Strategic Contracting for Reshoring

Key Takeaways

- Moving manufacturing operations back to the U.S. can reduce tariff exposure and simplify logistics, but it introduces new challenges such as labor shortages and operational risks. Companies must weigh these trade-offs carefully.

- To manage cost fluctuations, manufacturers are turning to well-crafted pricing adjustment clauses — either index-based (tied to public indices) or cost-based (tied to actual supplier costs) — to ensure fair and predictable pricing.

- With U.S. suppliers often operating near capacity, manufacturers should use tools like quantity commitments, liquidated damages, safety stock requirements, and diversified sourcing to protect against disruptions and ensure reliable supply.

Manufacturing supply chains have taken a beating in the last half-decade. Tariffs, natural disasters from climate change, COVID-19, and the Russia-Ukraine war have pushed C-suites to demand solutions—and supply chain teams are under pressure to restore continuity.

During the first Trump administration, a client with heavy reliance on Chinese manufacturing began the costly process of moving that manufacturing to India to avoid the Chinese tariffs. Now, India is under threat of high tariffs, and the client’s best-laid plans have been thwarted.

Given these quickly-shifting tariff dynamics across the world, one increasingly explored option to restore pricing and supply stability is to move production operations back to the U.S.

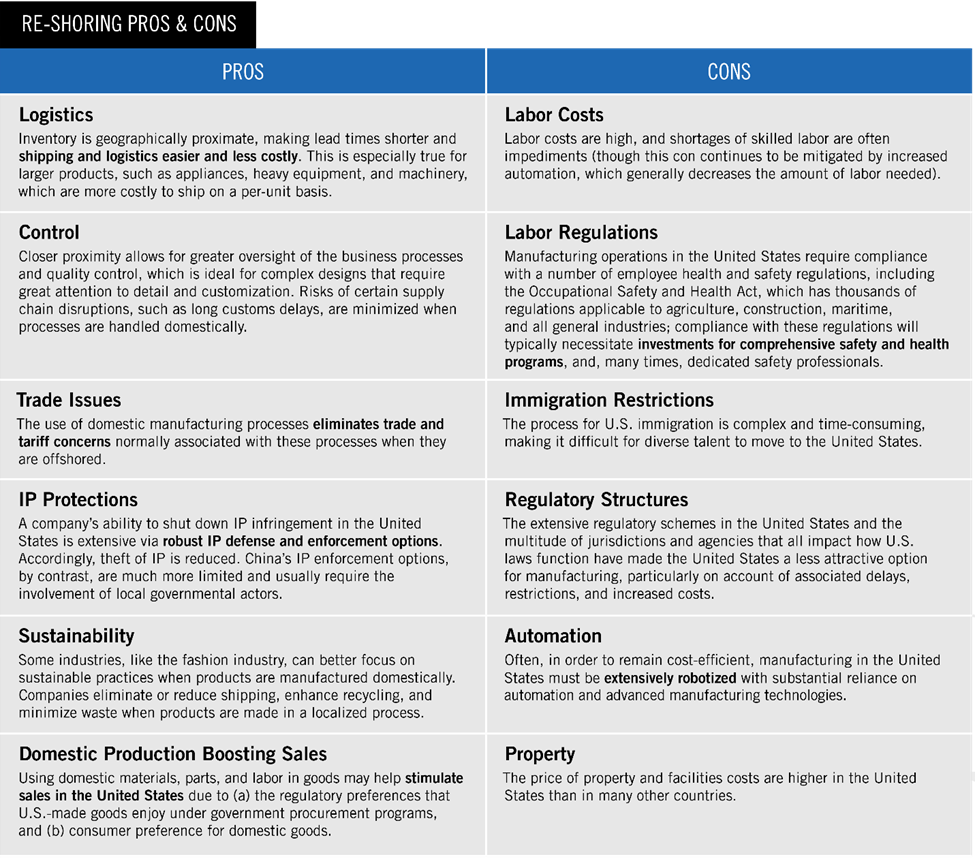

Reshoring gives businesses greater control over their processes through less complex and less costly logistics. But domestic manufacturing doesn’t automatically translate to supply chain simplicity. While domestic production can offer increased control, reduced logistics and tariff cost, and eligibility for certain incentives, it also introduces new commercial and operational complexities and risks. See the “Re-Shoring Pros & Cons” chart below for additional information on the re-shoring analysis.

To capture the benefits and manage the risks of U.S. manufacturing, companies should prioritize pricing stability and supply continuity in their commercial contracts.

1. Clauses to Increase Pricing Stability

U.S. manufacturers often assume that pricing stability will be easier to achieve domestically, especially without the concern of tariffs on the goods sold by the manufacturer into the U.S. market. However, they are quickly met with familiar difficulties: labor constraints, volatile raw material costs (including tariff risk on raw materials that continue to be imported from overseas), and inflationary pressures.

a. Index-Based Pricing Adjustments. Ideally, when purchasing raw materials, the manufacturer will have fixed pricing from the supplier. Absent that, carefully-drafted pricing adjustment clauses can help reduce volatility. These clauses are often tied to indices specific to the product components, such as steel, resin, or paper, or to general inflation measures like the Consumer Price Index (CPI) or Producer Price Index (PPI).

Some companies create a basket of indices in which each product input is assigned an index and a weighting, so that the increases and decreases of the indices assigned to each input will be netted to reach an overall adjustment to the price of the product. When structured correctly, pricing adjustment clauses can allow suppliers to recover increased costs while also protecting manufacturers from opportunistic pricing practices.

Index-based clauses are not without their downsides. They can be complicated to draft and to put into practice, and they require precise formulas, particularly if they use the weighted basket approach described above. Complex as it may be on the front end, this approach allows for precise pricing tied directly to published changes in cost on the back end.

b. Cost-Based Pricing Adjustments. Alternatively, pricing adjustment clauses based on actual costs (rather than indices) can be simpler, and they limit a supplier’s ability to increase profit margins over time. However, they require audits to verify a supplier’s costs. Asking suppliers to open their books and provide documentation on their sourcing and production costs may not be palatable or possible depending on negotiating leverage. With index-based clauses, these audits are not necessary, because any adjustments are tied to publicly-available indices.

2. Increasing Supply Continuity

With many U.S.-based suppliers operating near capacity—especially in the machining, electronics, and chemicals industries—it is critical for manufacturers to address supply continuity head-on with intentional drafting:

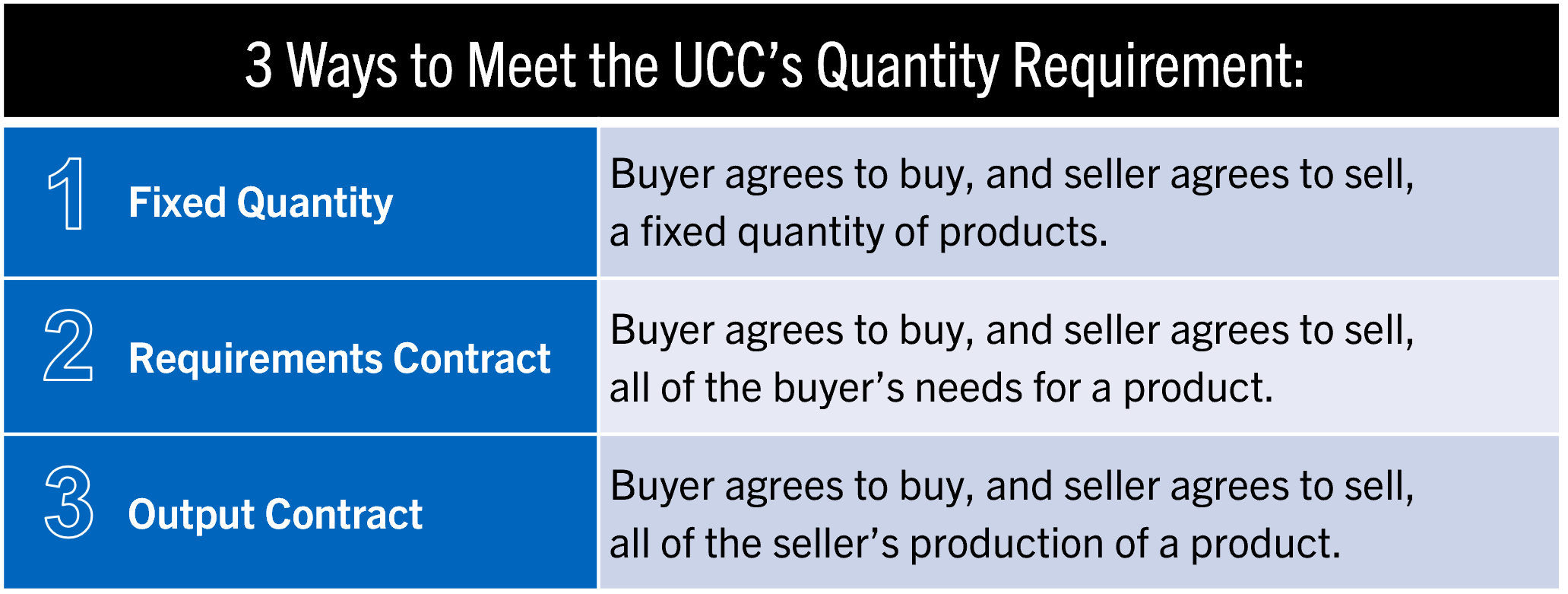

a. Quantity Commitment. Under Article 2 of Uniform Commercial Code (UCC), which governs the sale of goods in all states in the U.S. (other than Louisiana), a contract for the sale of goods is only enforceable up to the quantity of goods specified. But committing to buy specific quantities may not be practical or desirable in long term contracts or other arrangements in which a manufacturer’s supply needs may vary. Instead, a manufacturer may choose to enter into a “requirements contract” or an “output contract,” each of which meets the UCC’s quantity requirement:

b. Liquidated Damages. If damages for delay in delivery would be difficult to calculate, a liquidated damages clause can be another useful way to gain priority in on-time delivery. Such a clause establishes a clear, defined remedy for a supplier’s failure to perform on time, which, in turn, can incentivize the supplier to prioritize the manufacturer’s orders over other customers. This must be carefully crafted to ensure enforceability under the UCC and is only a viable option if the manufacturer has sufficient bargaining power.

c. Safety Stock. Requiring that the supplier hold in its inventory a certain level of stock in case of supply disruption also provides a safety net for the manufacturer. Oftentimes though, the supplier will pass through this inventory carrying cost through higher product prices.

d. Alternative Suppliers. Another method for increasing supply continuity is avoiding sole-source supply. Due to complexity in manufacturing, cost reasons, or supplier know-how, this is not always possible, but it is one of the best ways for a manufacturer to protect against unforeseen disruption, particularly if the suppliers are in geographically disparate regions.

Supply Chain Resilience Starts in the Fine Print

Locking in pricing stability and securing supply continuity can turn domestic production into a competitive advantage. Clarity on these contract terms will also provide an edge that endures. Manufacturers who get it right now will be the ones still standing when the next shock hits.