Tamar N. Dolcourt

Special Counsel

Tamar Dolcourt is a bankruptcy and restructuring attorney with Foley & Lardner LLP. Tamar represents clients in all aspects of bankruptcy proceedings. She is a member of the firm’s Bankruptcy & Business Reorganizations Practice and Cannabis Industry Team.

Tamar’s diverse bankruptcy practice includes representation of debtors-in-possession in Chapter 11, representation of secured lenders in bankruptcies and representation of unsecured creditors, both individually and on official committees.

Tamar also represents multiple clients in commercial real estate and personal property foreclosure matters, receivership, assignments for the benefits of creditors and related insolvency matters.

Representative Experience

- Represents distressed hospital system in its pending Chapter 11 bankruptcy

- Represents religious organization in its pending Chapter 11 bankruptcy

- Represents Joint Official Liquidators as foreign representatives in pending Chapter 15 bankruptcy

- Represented mid-sized manufacturing company in its bankruptcy proceeding, culminating in a successful going-concern sale of its business units

- Represented distressed hospital in its Chapter 11 case, culminating in a sale of the facility

- Represented a major contract counterparty in Chapter 9 bankruptcy proceeding

- Represented the Official Committee of Unsecured Creditors in an automotive supplier bankruptcy

- Represented the Official Committee of Unsecured Creditors in retail bankruptcy

- Represented the Liquidating Trustee in recovery of significant assets for defrauded investors

- Represented officers and directors of bankrupt entities in breach of fiduciary duty actions after bankruptcy

- Represented purchaser of catalog goods and intellectual property in Assignment for Benefit of Creditors sale process

- Represented secured lender in Article 9 sale in hotel industry

- Routinely counsels firm clients on bankruptcy and other troubled supplier and customer issues

- Represented one of the nation’s largest honey packers in its successful Chapter 11 reorganization

- Represented the Official Committee of Unsecured Creditors in the bankruptcy of a publicly-traded alternative energy company

- Represented the senior secured lender in a successful workout of a multi-million dollar commercial real estate matter

Presentations and Publications

- Speaker, “Bankruptcy and Healthcare in the Time of COVID-19,” American College of Emergency Physicians’ Frontline Podcast (April 27, 2020)

- Co-author, “Limited Options for Cannabis-Related Company Liquidations,” Foley’s Coronavirus Resource Center (April 3, 2020)

- Presenter, “Alternatives to Bankruptcy,” National Association of Credit Managers (January 28, 2020)

- Author, “Justices Setting New Standard for Discharged Debt Collection,” Law 360 (June 12, 2019)

- Co-author, “Are Your Suppliers in Trouble? Warning Signs and What to Do,” Industry Week (February 26, 2019)

- Co-author, “Junior Creditors Could Share in 363 Bankruptcy Sales,” Harvard Law School Bankruptcy Roundtable (October 9, 2018)

- Author, “Sixth Circuit Clarifies Approach to Mandatory Abstention,” Law 360 (June 18, 2018)

- Author, “The ABCs of Bankruptcy Filings by Assignees and Receivers,” Law 360 (January 27, 2016)

Foley Wins Non-Profit Turnaround of the Year Award for Heywood Healthcare Restructuring

Cannabis Mid-Year Update 2022

Update to Michigan’s Receivership Act

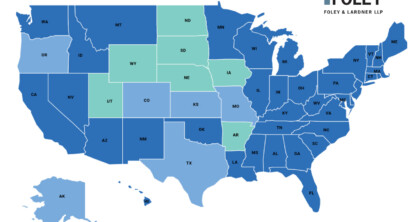

State-by-State Coronavirus Executive Order Tracker