The “Prior Acquisitions” Requirement Under HSR Rules

Overview of Requirement

The “Prior Acquisitions” section of the revised Hart-Scott-Rodino (HSR) form requires filers to report certain prior acquisitions they have made over the past five years. Importantly, this requirement only applies when the parties have identified a business overlap, i.e., when either (i) the parties report revenue under the same six-digit NAICS code or (ii) where the “Overlap Description” of the HSR form indicates a competitive overlap between the parties.

Where a business overlap exists, the “Prior Acquisitions” section requires filers to:

- Identify all acquisitions made within the past five years that contributed to the business overlap;

- Determine which acquisitions meet the criteria for reporting; the criteria are:

- The acquisition that contributed to the overlap must involve an acquisition of either (i) 50% or more of a legal entity, (ii) all or substantially all the assets of an operating business, or (iii) assets that otherwise met the HSR size-of-transaction test at the time of the acquisition; and

- The acquisition that contributed to the overlap must have involved an entity or assets with either annual net sales or total assets of more than $10 million in the year before the acquisition.

- For each prior acquisition that contributed to the business overlap and meets the criteria for reporting, state (i) the overlapping NAICS code(s) or competitive products/services from the Overlap Description; (ii) the acquired entity’s name and headquarters address prior to the acquisition; (iii) whether the transaction consisted of assets, voting securities, or non-corporate interests; and (iv) the consummation date of the acquisition.

Acquiring persons (buyers) should report this information for their entire organization, i.e., for the “ultimate parent” entity and every legal entity controlled by that ultimate parent.

Acquired persons (sellers) should report this information solely for the “target,” i.e., the business being sold.

How This Information Gets Used

The Federal Trade Commission and Department of Justice (the Agencies) use the “Prior Acquisitions” section of the HSR form to identify if either the buyer or the seller have engaged in a pattern of mergers or acquisitions in an industry or segment that poses an overlap. For example, the Agencies may consider whether the transaction being reported may be part of a larger “roll-up” strategy.

Illustration

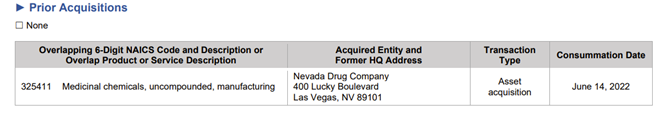

The FTC has provided a sample form that includes an illustration of how to report a relevant prior acquisition:

Practical Tips

In determining whether a prior acquisition had annual net sales or total assets of more than $10 million in the year before the acquisition, be sure to focus on “total” assets rather than “net” assets. An entity can have $10 million in total assets even if it was acquired for a much smaller amount. For example, an entity with $10 million in total assets and $9 million in debt might only be worth $1 million in net value, but it would nevertheless meet the criteria for reporting.

Frequently Asked Questions

Q: Do I need to report every prior acquisition we have ever made?

A: No. Prior acquisitions should only be reported where (i) there is a business overlap between the parties, (ii) the acquisition was made in the past five years, (iii) the acquisition involved an entity or assets with annual net sales or total assets of $10 million or more, and (iv) the acquisition represented either 50% of a legal entity, substantially all the assets of an operating business, or assets that otherwise met the HSR size-of-transaction test at the time of the acquisition.

Additionally for sellers, you should only report acquisitions of assets or entities that are included in the business being sold.

Q. What were the prior HSR size-of-transaction tests?

A. The HSR size-of-transaction test is adjusted every year to reflect changes in gross national product. Back to 2019, the size-of-transaction tests have been:

- For transactions that closed from 2/22/25 forward: $126.4 million

- For transactions that closed from 3/6/24 through 2/21/25: $119.5 million

- For transactions that closed from 2/27/23 through 3/5/24: $111.4 million

- For transactions that closed from 2/23/22 through 2/26/23: $101.0 million

- For transactions that closed from 3/4/21 through 2/22/22: $92.0 million

- For transactions that closed from 2/27/20 through 3/3/21: $94.0 million

- For transactions that closed from 4/3/19 through 2/26/20: $90.0 million

Q. If a prior acquisition was not HSR-reportable, do I still need to list it?

A. Yes, even if the prior acquisition was non-reportable, it still needs to be listed.

Q. How is this requirement different than the old HSR form?

A. Previously, information on prior acquisitions was only required for the Acquiring Person (buyer). In addition, the new requirement has fewer exclusions and also reaches competitive overlaps identified in the Overlap Description section of the form.

If you have questions about the “Prior Acquisitions” requirements under HRS rules or related issues, contact the authors or your Foley & Lardner attorney. Click here to access all of the Foley Antitrust & Competition Practice Group’s HSR Primers.