The “Subsidies” And “Countervailing Duties” Requirements Under HSR Rules

Overview of Requirement

The “Subsidies from Foreign Entities or Governments of Concern” section of the revised HSR form requires filers to report if they have, within the past two years, received any “subsidies” from any “foreign entity or government of concern,” such as China, Russia, North Korea, Iran, or a foreign terrorist organization. Filers are also required to disclose if any such entity has given them a “commitment to provide a subsidy in the future.”

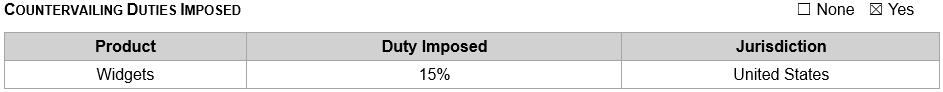

In addition, filers are required to disclose if they produce any products “in whole or in part” in a “covered nation” (i.e., China, Russia, North Korea, or Iran) that is subject to “countervailing duties imposed by any jurisdiction.” “Countervailing duties” are a certain form of tariff that is imposed on imported goods specifically to offset subsidies provided by a foreign government that have been deemed to give the producer an unfair pricing advantage. To the extent the filer produces any such products in a covered nation, the filer must list the product, the jurisdiction that has imposed the countervailing duty, and countervailing duty itself. Filers are also required to disclose if they produce any products in a covered nation that are “the subject of a current investigation for countervailing duties in any jurisdiction.”

These requirements apply to the filer’s entire organization and are not limited to the particular business unit or products at issue in the transaction being reported.

How This Information Gets Used

Congress specifically added a requirement to disclose subsidies from foreign entities or governments of concern in the Merger Modernization Act of 2022. According to Congress, foreign subsidies from such countries or entities “can distort the competitive process by enabling the subsidized firm to submit a bid higher than other firms in the market, or otherwise change the incentives of the firm in ways that undermine competition.” In practical terms, the FTC and DOJ use the information about subsidies and countervailing duties to assess whether foreign financial support from a nation or entity of concern could influence the merged firm’s competitive behavior or market position in ways that might raise antitrust concerns.

Illustration

The FTC has not provided formal guidance on how precisely to report information regarding subsidies, countervailing duties, or countervailing duty investigations. However, in an appropriate case a filer might consider language along the following lines.

Practical Tips

- Subsidies. While “subsidy” has a specific statutory definition, the term generally refers to any financial assistance, support, or advantage provided by a qualifying government, entity, or person. This can take many forms, including but not limited to direct payments, grants, loans on favorable terms, tax credits, price supports, or any other mechanism that leaves the recipient financially better off than it would have been without the government or entity’s involvement.

- “Foreign entity or government of concern.” As of the date of this guidance, the term “foreign entity or government of concern” encompasses:

- The People’s Republic of China;

- The Russian Federation

- The Democratic People’s Republic of North Korea;

- The Islamic Republic of Iran; and

- Entities or natural persons that are:

- Owned by, controlled by, or subject to the jurisdiction or direction of China, Russia, North Korea, or Iran;

- Designated as a foreign terrorist organization by the Department of State;

- Listed in the “Specially Designated Nationals and Blocker Persons List” maintained by the Department of the Treasury’s Office of Foreign Assets Control (OFAC);

- Alleged and convicted of certain national-security-related crimes involving, among other things, espionage, unauthorized disclosure of sensitive information, export-control violations, or misuse of economic or technological assets; and/or

- Designated by the Secretary of Energy to be engaged in unauthorized conduct detrimental to U.S. national or foreign policy.

Frequently Asked Questions

Q. Is there a comprehensive list of entities and persons qualifying as a “foreign entity or government of concern” that I can refer to in order to help identify a list of reportable subsidies?

A. No, the United States government has not released a comprehensive list of all entities and persons that would qualify as a foreign entity or government of concern. Partial lists can be found on the websites for the Department of State and OFAC. In particular, if you suspect that an entity (including but not limited to “state-owned enterprises”) or person has granted you a subsidy and may be considered to be “owned by, controlled by, or subject to the jurisdiction” of a covered nation (China, Russia, North Korea, or Iran), check with experienced legal counsel for guidance on whether or how to report that subsidy.

Q. Our company has substantial operations in China, including several local subsidiaries and branches. These subsidiaries and branches receive all types of tax credits and incentives that we would consider “ordinary course,” including routine credits for research and development, VAT rebates commonly available to exporters, and local employment or payroll-related incentives. Do I need to report all such credits and incentives, even the ones that seem de minimis?

A. Technically yes, all such tax credits and incentives are likely reportable as “subsidies.” However, as shown in the second “Illustration” example above, a high-level description of the various tax credits and incentives may be acceptable, particularly if they are not directly related to the production or sale of overlap, related sales, or related purchase products or services. In these cases, we often advise including a specific note to make clear that the subsidies have no connection to the business unit or products at issue in the transaction being reported.

Q. Would consideration received at normal, market-level rates from a Chinese government entity in exchange for supplying a product or service to that entity in the ordinary course of business qualify as a reportable subsidy?

A. No, such ordinary-course commercial transactions would generally not be considered a “subsidy.” For commercial transactions of this sort, the consideration would only be considered a “subsidy” if the purchase price was “for more than adequate remuneration.” However, such cases can be very technical, so if you have any commercial transactions that might raise such questions, please check with experienced legal counsel for guidance.

Q. Would the receipt of financial payments from an individual foreign national or wholly private entity ever be considered a reportable subsidy?

A. In certain circumstances, yes, it may be a reportable subsidy. According to FTC guidance, if a payment can be described as being made through an intermediary that a government had “entrust[ed]” or “direct[ed]” to make the payment, and the payment is something that would “normally be vested in the government and the practice does not differ in substance from practices normally followed by governments,” then it may be considered a reportable subsidy.

Q. Can I limit my reporting of subsidies, countervailing duties, and countervailing duty investigations to ones that specifically relate to the business unit or products at issue in the transaction?

A. No – filers must report all applicable subsidies, countervailing duties, and countervailing duty investigations, across the organization as a whole. For example, if a private equity fund is selling one portfolio company, the private equity fund must also include subsidies, countervailing duties, and countervailing duty investigations for other portfolio companies included within that fund, even if those other portfolio companies have no connection whatsoever with the transaction being reported.